To print this article, all you need is to be registered or login on Mondaq.com.

Policyholders of group insurance policies may require a licence

from the Netherlands Authority for the Financial Markets

(AFM) as an intermediary from 1 October 2025.This

licensing requirement is relevant for a wide range of companies

including, for example, companies in the transport and moving

sector that offer insurance to their customers where the companies

concerned are themselves policyholders. According to the AFM, if

the policyholder of a group insurance policy offers its customers a

choice of joining the insurance policy and the policyholder

receives a fee for this in return, this qualifies as providing

intermediary services for which, in principle, a licence is

required. If a licence is required, it must be obtained before 1

October 2025.

Background and the interpretation

The AFM’s interpretation is a consequence of a judgment of

the Court of Justice of the European Union (CJEU 29 September 2022,

C-633/20, ECLI:EU:C:2022:733). With the interpretation, the AFM

provides further guidance for practice. According to the

parliamentary history of the concept of the provision of

intermediary services, the term “intermediary” expresses

that the intermediary does not become a party to the insurance

contract. However, the CJEU does not consider it decisive whether

the intermediary is itself a party to the insurance contract, what

is relevant is whether a party performs similar activities for a

fee.

Licensing requirement for group insurances

A group insurance is an insurance contract entered into between

a policyholder and insurer under which one or more third persons

may be included as insured person(s) on the policy. According to

the AFM’s interpretation, if the following two conditions are

met for group insurance, there is a licensing obligation for the

provision of intermediary services:

- There is an optional element; and

- A fee is paid.

Optional element – automatic or non-automatic

inclusion

If the insured is automatically added to a group insurance

policy and does not have an option to do so, this does not

constitute intermediary activities for which a licence is required.

This could include the situation where a child is enrolled by its

parents at a school, where the child is automatically added as an

insured in the school’s accident insurance.

It is different when the insured has the choice to join the

insurance contract, which allows the insured to decide whether to

take up the offer of insurance. This is non-automatic entry. The

offering of certain options or the possibility of dropping certain

options within the offered insurance is also seen by the AFM as an

optional element. By way of illustration, this includes the

situation where a moving company offers the option of taking out

insurance against damage to the goods on the moving day.

Remuneration

In addition to the fact that there must be a non-automatic entry

into a group insurance policy, the policyholder must receive

remuneration for the service provided in order to trigger the

licence requirement. The concept of remuneration should be

interpreted broadly. Any (economic) benefit of any kind qualifies

as a remuneration.

The AFM clarifies in its interpretation that there must be a

financial benefit for the policyholder – passing on premiums and

(administrative) costs is not considered as a fee by the AFM. This

means that if the group insurance is offered to the customer as a

‘service’ without providing any financial benefit to the

policyholder, there are no intermediary service provided for which

a licence is required.

Secondary insurance intermediary: exception from Section

7 Exemption regulation Wft

In the situation where there is (i) freedom of choice for the

customer and (ii) a remuneration for the policyholder, in

principle, a licensing obligation as intermediary applies. In those

cases, the exemption regulation is still relevant. Section 7 of the

Exemption regulation Wft (Vrijstellingsregeling Wft)

regulates that persons who mediate in insurance in addition to the

supply of an item or the provision of a service are largely exempt

from the Dutch Act on Financial Supervision (Wet op het

financieel toezicht) under certain conditions. To qualify for

this exemption, certain conditions must be met. This means that if

the policyholder of a group insurance policy can demonstrate that

the insurance product being offered meets the conditions set out in

Section 7 of the Exemption regulation Wft, the policyholder can

make use of this exemption and the licensing obligation does not

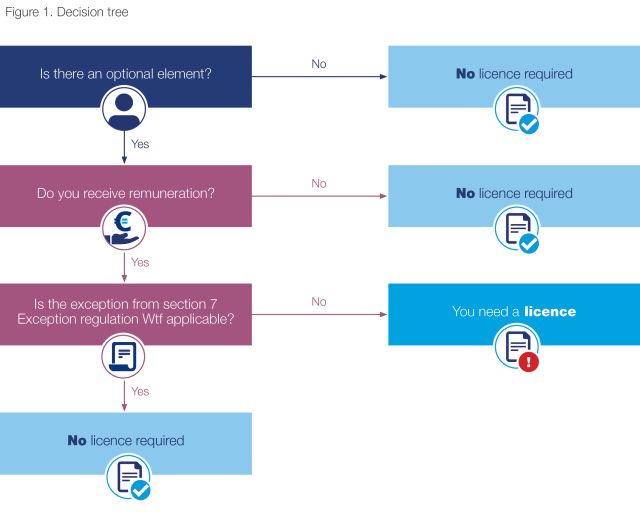

apply after all. The foregoing can be depicted as follows:

Based on the interpretation of the AFM.

Next step

The AFM’s interpretation may have a significant impact on

market parties who currently do not have a licence for

(intermediary) activities in group insurance. For each group

insurance policy, it will have to be determined whether there are

intermediary activities that requires a licence. The decision tree

as depicted above can be helpful in this respect. If a licensing

obligation arises, we recommend taking action on this quickly, as

the relevant companies must have a licence no later than 1 October

2025.

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.

POPULAR ARTICLES ON: Insurance from Netherlands